Feasibility study

A feasibility study is part of the initial design stage of any project/plan. It is conducted in order to objectively uncover the strength and weakness of a proposed project or an existing business. It can help to identify and assess the opportunities and threats present in the natural environment, the resources required for the project, and the prospects for success.

Components of Techno-Economic Feasibility Studies

Following are the contents of techno-economic feasibility studies:

(a) Project background and history

(b) Demand and market study

(c) Demand projections

(d) Forecasting techniques

(e) Export projections

(f) Market penetration

(g) Sensitivity analysis

(h) Sales forecast and marketing

(i) Production program

(j) Plant capacity

(k) Materials and inputs

(l) Supply programme

(m) Project location

(n) Plant site, within the location

(o) Local conditions

(p) Layout and physical coverage of project

(q) Technology and equipment

(r) Civil engineering

(s) Plant organization

(t) Overhead costs

(u) Labour

(v) Staff

(w) Implementation scheduling

(x) Financial evaluation

(y) Economic evaluation

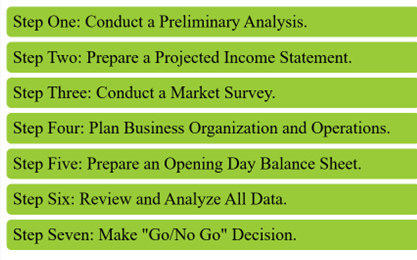

Steps in feasibility study

•Step One: Conduct a Preliminary Analysis.

•Step Two: Prepare a Projected Income Statement.

•Step Three: Conduct a Market Survey.

•Step Four: Plan Business Organization and Operations.

•Step Five: Prepare an Opening Day Balance Sheet.

•Step Six: Review and Analyze All Data.

•Step Seven: Make “Go/No Go” Decision.

4 elements of feasibility study

1) Technical feasibility: A technical feasibility study reviews the technical resources available for your project. This study determines if you have the right equipment, enough equipment, and the right technical knowledge to complete your project objectives. For example, if your project plan proposes creating 50,000 products per month, but you can only produce 30,000 products per month in your factories, this project isn’t technically feasible.

2) Financial feasibility: Financial feasibility describes whether or not your project is fiscally viable. A financial feasibility report includes a cost/benefit analysis of the project. It also forecasts an expected return on investment (ROI), as well as outlines any financial risks. The goal at the end of the financial feasibility study is to understand the economic benefits the project will drive.

3) Market feasibility: The market feasibility study is an evaluation of how your team expects the project’s deliverables to perform in the market. This part of the report includes a market analysis, market competition breakdown, and sales projections.

4) Operational feasibility: An operational feasibility study evaluates whether or not your organization is able to complete this project. This includes staffing requirements, organizational structure, and any applicable legal requirements. At the end of the operational feasibility study, your team will have a sense of whether or not you have the resources, skills, and competencies to complete this work.

Demand forecasting

Demand forecasting is the process of using predictive analysis of historical data to estimate and predict customers’ future demand for a product or service. Demand forecasting helps the business make better-informed supply decisions that estimate the total sales and revenue for a future period of time.

Types of Demand Forecasting

1. Passive demand forecasting:

Passive demand forecasting is the simplest type. In this model, you use sales data from the past to predict the future. You should use data from the same season to project sales in the future, so you compare apples to apples. This is particularly true if your business has seasonal fluctuations.

2. Active demand forecasting

If your business is in a growth phase or if you’re just starting out, active demand forecasting is a good choice. An active forecasting model takes into consideration your market research, marketing campaigns, and expansion plans.

3. Short-term projections

Short-term demand forecasting looks just at the next three to 12 months. This is useful for managing your just-in-time supply chain. Looking at short-term demand allows you to adjust your projections based on real-time sales data. It helps you respond quickly to changes in customer demand.

4. Long-term projections

Your long-term forecast will make projections one to four years into the future. This forecasting model focuses on shaping your business growth trajectory. While your long-term planning will be based partly on sales data and market research, it is also aspirational.

5. External macro forecasting

External macro forecasting incorporates trends in the broader economy. This projection looks at how those trends will affect your goals. An external macro demand forecast can also give you direction for how to meet those goals.

6. Internal business forecasting One of the limiting factors for your business growth is internal capacity. If you project that customer demand will double, does your enterprise have the capacity to meet that demand? Internal business demand forecasts review your operation.

Methodologies of demand forecasting

1. Trend projection

Trend projection uses your past sales data to project your future sales. It is the simplest and most straightforward demand forecasting method.

2. Market research

Market research demand forecasting is based on data from customer surveys. It requires time and effort to send out surveys and tabulate data, but it’s worth it. This method can provide valuable insights you can’t get from internal sales data.

3. Sales force composite

The sales force composite demand forecasting method puts your sales team in the driver’s seat. It uses feedback from the sales group to forecast customer demand.

4. Delphi method

The Delphi method, or Delphi technique, leverages expert opinions on your market forecast. This method requires engaging outside experts and a skilled facilitator.

5. Econometric

The econometric method requires some number crunching. This technique combines sales data with information on outside forces that affect demand. Then you create a mathematical formula to predict future customer demand.