MACRO ECONOMIC ISSUES (I)

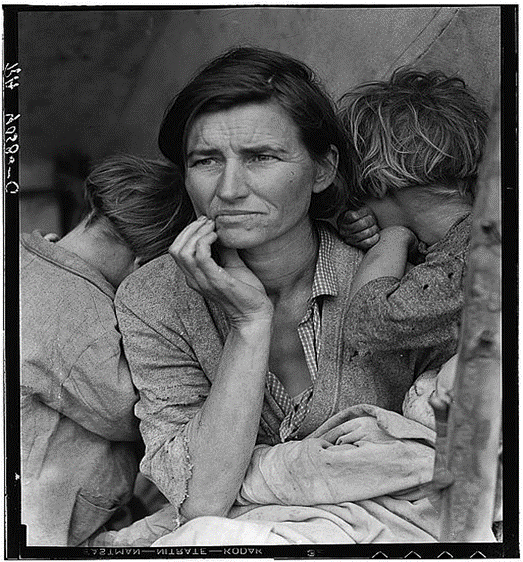

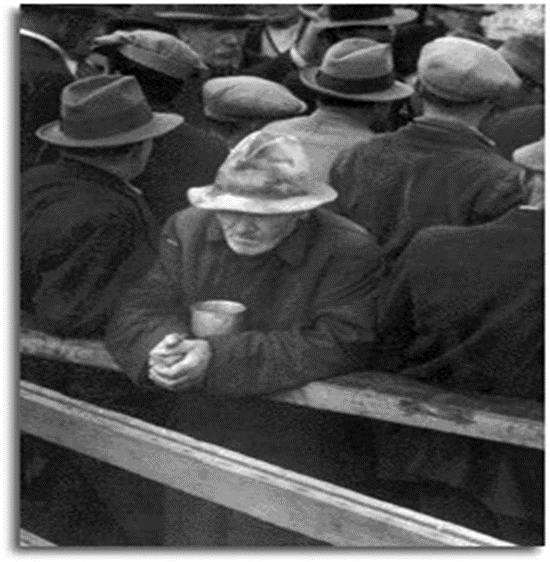

THE GREAT DEPRESSION BEGINS

The Great Depression of 1920’s

As the 1920s advanced, serious problems threatened the economy while Important industries struggled, including:

•Agriculture

•Railroads

•Textiles

•Steel

•Mining

•Lumber

•Automobiles

•Housing

•Consumer goods

Consumer spending down

By the late 1920s, American consumers were buying less. Rising prices, stagnant wages and overbuying on credit were to blame. Most people did not have the money to buy the flood of goods factories produced.

Stock prices rise through the 1920s

Through most of the 1920s, stock prices rose steadily. The Dow reached a high in 1929 of 381 points (300 points higher than 1924). By 1929, 4 million Americans owned stocks.

Causes of the Great Depression:

Tariffs & war debt policies

U.S. demand low, despite factories producing more Farm sector crisis

Easy credit

Unequal distribution of income

Global recession of 2008

Recession In economics, the term recession descries the reduction of a country’s Gross Domestic Product (GDP) for at least two quarters. The usual dictionary definition is “a period of reduced economic activity” A recession is a contraction of business cycle.

Recession that affects many countries around the world. That is, a period of economic slowdown or declining economic output.

Since world war II there were only four global recessions:

July 1980 – November 1982

(2 years total)

July 1990 – March 1991

(8 months)

March 2001- November 2001

(8 months)

December 2007- March 2009 (15 months)

Impact of recession in India:

Indian companies have major outsourcing deals from the US.

India’s exports to the US have also grown sustainability over the years.

For the first time in five years, India’s export growth has turned negative.

Exports for October 2008 contracted by 15% on a year- on-year basis as over 40% of India’s export market had been slowing for months.

This became on those reasons due to recession stroked India.

Corrective Steps Taken to Check Recession

RBI needed to neutralize the outflow of FII money by unwinding the market.

In the IT sector, there should be correction in salary offerings rather than job cutting.

Public should spend wisely and save more.

Taxes including excise duty and custom duty should be reduced to lighten the adverse effect of economic crunch on various industries.

In real estate the builders should drop prices, so as to bring buyers back into the market.

Current Economic Scenario-Impact of Recession on India

Recession has grabbed almost all the organizations of the world.

Several people have lost jobs – facing the financial problems.

Government – doing best to come out of the problem. Banks are providing business loans at low rate.

Government – providing money packages to organizations.

If I talk about India, here the situation is still satisfactory if compare it with other countries of the world.

Reserve bank of India (RBI) has decreased the rate of interest.

SBI and ICICI are also providing different types of loans at a low rate of interest.

Organizations are cutting cost to stand in the market. Export businesses of India is going up.

The real state was doing good business.

But now a days the condition of real state is still worse because of recession.

Euro Zone

It is an economic and monetary union (EMU) of 16 European Union (EU) member states They have adopted the euro as their sole trading currency. Euro became a reality on Jan 1, 1998 , but came for the European consumers on Jan 1 2002. It currently consists of Austria, Belgium, Cyprus, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

Introduction to Euro Zone crisis

It is the biggest challenge Europe has faced since 1990. Due to global financial crisis that began in 2007-08 the euro zone entered its first official recession in third quarter of 2008. The official figures were released in 2009 Jan. On 11 Oct 2008, a summit was held in Paris by the Euro group heads of state and Govt., to define a joint action plan for euro zone and central banks of Europe to stabilize the economy.

Beginning of Crisis

Started in – Oct 2009 in Greece. Its immediate causes lie with the US crisis of 2007-09. The result in Euro Zone was Sovereign debt crisis.

PIIGS: Portugal, Italy, Ireland, Greece, Spain.

Countries Affected By Greek Crisis

South-eastern Europe

Neighboring Serbia, Albania, Macedonia, Bulgaria and Turkey

IMPACT

Contagion Effect:

Greek crisis has made investors nervous about lending money to governments through buying government bonds.

Reduced wealth:

Take-home pay is likely to fall as it is eroded by rising taxes. Impact on private individuals

Effect on India

India’s exports to Europe could witness a slump to 10%.

Export driven sectors such as textiles and software are likely to bear the brunt.

About 22-28 percent of revenues of India’s top tech majors come from Europe whose revenues will definitely be affected. Government’s overall target of $200 billion for the fiscal could be at stake.

WTO and its impact of Indian Agriculture

World Trade organization

“The World Trade Organization is ‘member-driven’, with decisions taken by General agreement among all member of governments and it deals with the rules of trade between nations at a global or near-global level. But there is more to it than that.”

The World Trade Organization (WTO) is an organization that intends to supervise and liberalize international trade.

The WTO is the only global international organization dealing with the rules of trade between nations.

WTO: The Beginnings/ History

The World Trade Organization (WTO) came into being on January 1st 1995.

It was the outcome of the lengthy (1986-1994) Uruguay round of GATT negotiations.

The WTO was essentially an extension of GATT. It extended GATT in two major ways.

First GATT became only one of the three major trade agreements that went into the WTO (the other two being the General Agreement on Trade in Services (GATS) and the agreements on Trade Related Aspects of Intellectual Property Rights (TRIPS).

Objective of WTO

The primary aim of WTO is to implement the new world trade agreement.

To promote multilateral trade .

To promote free trade by abolishing tariff & non tariff barriers.

To enhance competitiveness among all trading partners so as to benefit consumers.

To increase the level of production & productivity with a view to increase the level of employment in the world.

To expand & utilize world resources in the most optimum manner.

To improve the level of living for the global population & speed up economic development of the member nations.

To take special steps for the development of poorest nations.

Functions of WTO

Implementing WTO agreements & administering the international trade.

Cooperating with IMF & World Bank & its associates for establishing coordination in Global Trade Policy-Making.

Settling trade related disputes among member nations with the help of its Dispute Settlement.

Reviewing trade related economic policies of member countries with help of its Trade Policy Review Body (TPRB).

Providing technical assistance & guidance related to management of foreign trade & fiscal policy to its member nations.

Acting as forum for trade liberalization.

India is one of the founder members of WTO.

WTO and Indian Agriculture

Introduction After over 7 years of negotiation the Uruguay Round multilateral trade negotiations were concluded on December 1993 and were formally ratified in April 1994 at Marrakesh, Morocco. The WTO agreement on agriculture was one of the main agreements which were negotiated during the Uruguay round.

Agreement on Agriculture

The WTO Agreement on Agriculture contains provisions in three broad areas of agriculture.

1.Market access.

2.Domestic support.

3.Export subsidies.

1) Market access

This includes tariffication, tariff reduction and access opportunities. Tariffication means that all non-tariff barriers such as….

1.Quotas

2.Variable levies

3.Minimum import prices

4.Discretionary licensing

5.State trading measures

AOA provisions on market access:

Prohibition of quantitative restriction on import

Tariff binding and reduction

Bound versus Applied tariffs

Tariff Rate Quota Special safeguard measures

2) Domestic Support

WTO uses a traffic light analogy to group program

Green box (non-trade distorting)

Blue box (production limiting)

Amber box (market distorting)

Prohibited(i.e. red box)

3) Export subsidies:

En export subsidy reduce the price paid by foreign importer, which mean domestic consumer pay more than foreign consumer Export subsidy in Agricultural Sector

Direct export subsidies contingent on export performance

Sale of non-commercial product on less prices than domestic market

Producer financed subsidy Cost reduction measures

Some of agricultural product under 23 product groups, such as wheat, coarse grain, sugar, beef, cheese and oilseeds.

Rates of cut Developed countries:

1)21% by volume

2)6% corresponding budgetary outlay 3)Over 6 years

Developing countries:

1)14% by volume

2)24% corresponding budgetary outlay

3)Over 10 years

Textile Industry:

The Indian Textile Industry counts among the leading textile industries in the world.

India’s textile industry contributes about

1)14 per cent to industrial production;

2)4 per cent to the country’s gross product (GDP);

3)17 per cent to its export earnings;

Abundant raw materials, healthy foreign direct investments (FDI) and a government willing to invest ensures a bright future for India’s textile sector.

Second largest textile fiber producer in the world.

India is the largest cotton and jute producer in the world.

Nine million tones of fiber production in 2015-16.

Second largest textile manufacturing capacity globally.

India accounts for 18% of world’s spindles and 9% of world’s rotor. 5% share in global textiles and apparel trade.

Current facts on Indian textile industry

India retained its position as world’s second highest cotton producer.

Acreage under cotton reduced about 1 % during 2008-09.

The productivity of cotton which was growing up over the years has decreased in 2008-09.

Substantial increase of Minimum Support Prices (MSPs).

Cotton exports couldn’t pick up owing to disparity in domestic and international cotton prices.

Imports of cotton were limited to shortage in supply of Extra Long staple cottons.

Important benefits offered by the Indian textile industry

India covers 61 percent of the international market.

India covers 22 percent of the global market.

India is known to be the third largest manufacturer of cotton across the globe.

India claims to be the second largest manufacturer as well as provider of cotton yarn and textiles in the world.

India holds around 25 percent share in the cotton yarn industry across the globe.

India contributes to around 12 percent of the world’s production of cotton yarn and textiles.

Reasons To Invest

Abundant availability of raw materials such as cotton, wool, silk, jute and manmade fibers.

Comparative advantage in terms of skilled manpower and cost of production over major textile producers across globe.

Focused and favorable policies instituted by the government will give the industry a fillip.

Presence of entire value chain for textile production beginning from production of natural fiber to the production of yarn, fabric and apparel within the country giving edge over countries like Vietnam, Bangladesh etc.

Presence of traditional skill sectors i.e. hand loom and handicraft.

Market access arrangements with Japan, South Korea, ASEAN, Chile while negotiations with EU, Australia, Regional Comprehensive Economic Partnership (RCEP) countries under process.

Readily available market which is poised to grow in future with increased penetration of organized retail, favorable demographics and rising income levels.

The Integrated Skill Development Scheme aims to train over 2.675 million people up to 2017, covering all sub- sectors of the textile sector- textiles and apparel, handicrafts, handlooms, jute and sericulture

The Centers of Excellence focused on testing and evaluation as well as resource centers and training facilities have been set up.

Special Economic Zone(SEZ)

It is a specifically delineated duty-free enclave and shall be deemed to be foreign territory for the purposes of trade operations and duties and tariffs.

In order words, SEZ is a geographical region that has economic laws different from a countries typical economic laws.

SEZ Background

•An SEZ Policy was announced for the very first time in 2000 in order to overcome the obstacles businesses faced.

•There were multiple controls and many clearances to be obtained before starting a venture.

•Infrastructure facilities were shoddy and well below world standards in India.

•The fiscal regime was unstable as well.

•In order to attract huge foreign investments into the country, the government announced the Policy.

•The Parliament passed the Special Economic Zones Act in 2005 after many consultations and deliberations.

•The Act came into force along with the SEZ Rules in 2006.

•However, SEZs were operational in India from 2000 to 2006 (under the Foreign Trade Policy).

Special Economic Zones Act, 2005 “It is defined as an Act to provide for the establishment, development and management of the Special Economic Zones for the promotion of exports and for matters connected therewith or incidental thereto.”

The chief objectives of the SEZ Act are:

•To create additional economic activity.

•To boost the export of goods and services.

•To generate employment.

•To boost domestic and foreign investments.

•To develop infrastructure facilities.

SEZ Rules

•Simplified procedures to develop, operate and maintain SEZs and also to set up units and conduct businesses in the SEZs.

•Single-window clearance to set up a Special Economic Zone, and also to set up a unit in an SEZ.

•Single-window clearance for matters connected to the Central and State governments.

•Simplified compliance procedures and documentation with a focus on self-certification.

•Different minimum land requirements for different classes of Special Economic Zones.

SEZs Facilities & Incentives

•The government offers many incentives for companies and businesses established in SEZs. some of the important ones are:

•Duty-free import or domestic procurement of goods for developing, operating and maintaining SEZ units.

•100% Income tax exemption on export income for SEZ units under the Income Tax Act for first 5 years, 50% for next 5 years thereafter and 50% of the ploughed back export profit for next 5 years. (Sunset Clause for Units will become effective from 2020).

•Units are exempted from Minimum Alternate Tax (MAT).

•They were exempted from Central Sales Tax, Service Tax and State sales tax.

•These have now subsumed into GST and supplies to SEZs are zero-rated under the IGST Act, 2017.

•Single window clearance for Central and State level approvals.

•There is no need for a license for import.

•In the manufacturing sector, barring a few segments, 100% FDI is allowed.

•Profits earned are permitted to be repatriated freely with no need for any dividend balancing.

Export processing zone(EPZ)

An export processing zone, or EPZ, is an area set up to enhance commercial and industrial exports by encouraging economic growth through investment from foreign entities. Incentives such as tax exemptions and a barrier-free environment are the main attractions of an EPZ. The main goals and benefits of an EPZ are growth from foreign exchange earnings through nontraditional exports, creation of jobs to assist in income generation and develop labor skill sets, the attraction of direct foreign investment, and fostering of transfer of technology.

The History of Export Processing Zones

Export Processing Zones first appeared in the 19th century in the form of free trade zones at ports located in Singapore, Hong Kong, and Gibraltar.

Formally implemented in the 1930s, EPZs encourage foreign investment in a country.

By the 1970s, export processing zones gained popularity to the point where many countries used the mechanism to boost their economy through investment from more advanced nations.

In 2006, approximately 130 countries founded over 3,500 EPZs.

Some of these zones were so extensive that residential neighborhoods were actually established within the zone, such as in Chinese Special Economic Zones.

EPZs have now evolved to the point where they can include resorts, designated finance zones, technological parks, and centers dedicated to logistics.

Features of the Export Processing Zone

Companies based in an EPZ tend to benefit from tax concessions that are generally long-term in nature.

Imports of materials and goods for export are duty-free.

While parts of countries that do not contain EPZs can remain underdeveloped in terms of technology and infrastructure, EPZs are fitted with advanced communication facilities and enhanced infrastructure.

These zones also provide subsidies for utilities and rent to their occupants.

EPZ zones can accommodate both domestic and foreign firms; they even offer the opportunity for joint venture operations.

The zones are typically located in the vicinity of ports of air and sea, therefore making the import and export process more convenient.

Companies do not require as much government approval for practices as firms outside of the zone, with labor laws being more flexible.

Differentiating factors of EPZs are related to the management and quality of goods, services provided, and facilities. EPZs can be managed either publicly or privately.

Disadvantages of Export Processing Zones

There are significant benefits associated with the establishment of an EPZ, with countries such as China, Indonesia, and South Korea boasting great benefits.

However, countries like the Philippines have faced poor performance from EPZs.

In this example, the cost of establishment of the facilities has outweighed the gains in profits.

Free trade zone (FTZ)

It is a designated area that eliminates traditional trade barriers, such as tariffs, some kind of taxes and fees and minimizes bureaucratic regulations.

The goal of a free trade zone is to enhance global market presence of the Country or location by attracting new business and foreign investments.

Tax-free trade zones generate foreign exchange through exports, and create economic value added.

Free, foreign, and export processing zones all fall under the umbrella of being free trade zones.

Tax-free trade zones have four policy objectives:

To attract foreign direct investment To decrease unemployment

To support economic reform strategies by developing and diversifying exports

To test new approaches to foreign direct investment and to policies related to law, land, labor, and the pricing of goods.

KEY BENEFITS OF FTZS IN INDIA

Different benefits can be obtained by a reputed and professional FTWZs. Some of them are mentioned below

Duty freedom

Duty & Tax Deferments

World-class infrastructure

Superior and timely services