MARKETS

The term market has come to signify a public place in which goods and services are bought and sold. It is the act or technique of buying and selling.

Market defines, “any area over which buyers and sellers are in such close touch with one another, either directly or through dealers, that the prices obtainable in one part of the market affect the prices paid in other parts.”

Therefore, market in economic sense implies:

1.Presence of buyers and sellers (Producers) of the commodity

2.Establishment of contract between the buyers and sellers

3.Similarity of the product

4.Exchange of commodity for a price

Classification of Markets

1.Markets on the basis of Area

2.Markets on the basis of Time

3.Markets on the basis of ‘Nature of Transactions’

4.Markets on the basis of ‘Regulation’

5.Markets on the basis of ‘Volume of Business’

6.Market on the basis of ‘Position of Sellers’

7.Market on the basis of type of ‘Competition’

1. Markets on the basis of Area

On the basis of geographical area covered, markets are classified into

(a)Local Markets,

(b)Regional Markets,

(c)National Markets, and

(d)International Markets.

2. Markets on the basis of Time

Alfred Marshall conceived the ‘Time’ element in marketing and this is classified into

(a)Very short-period market,

(b)Short-period market,

(c)Long-period market, and

(d)Very long-period or Secular market.

3. Markets on the basis of Nature of Transactions

On the basis of nature of transactions, markets are classified into

(a)Spot market; and

(b)Future market.

Spot transaction or spot markets refer to those markets where goods are physically transacted on the spot, whereas Future markets related to those transactions which involve contracts of the future date.

4. Markets on the basis of ‘Regulation’

On the basis of regulation, markets are classified into

(a)Regulated market

(b)Unregulated market

In the former type of markets transactions are statutorily regulated so as to put an end to unfair practices.

Such markets may be established for specific products or a group of products.

Produce and stock exchanges are suitable examples of the regulated markets.

5. Markets on the basis of ‘Volume of Business’

Based on the volume of business transacted, markets are classified into Wholesale market and Retail market.

The wholesale market comes into existence when the commodities are bought and sold in bulk or large quantities. The dealers in this market are known as the wholesalers.

The wholesaler acts as an intermediary between the producer and the retailer.

Retail market, on the other hand exists when the commodities are bought and sold in small quantities.

This is the market for ultimate consumers.

6. Market on the basis of ‘Position of Sellers’

On the basis of the position of the sellers in the chain of marketing, markets are divided into Primary market, Secondary market and the Terminal market.

Manufacturers of commodities constitute the primary market who sell the products to the wholesalers.

The secondary market consists of wholesalers who sell the products in bulk to the retailers.

Retailers along constitute the terminal markets who sell the products to the ultimate consumers.

7. Markets on the basis of type of ‘Competition’

Based on the type of competition, markets are classified into

(a)Perfectly Competitive market

(b)Imperfect market

The opposite type of perfect market is ‘Monopoly’.

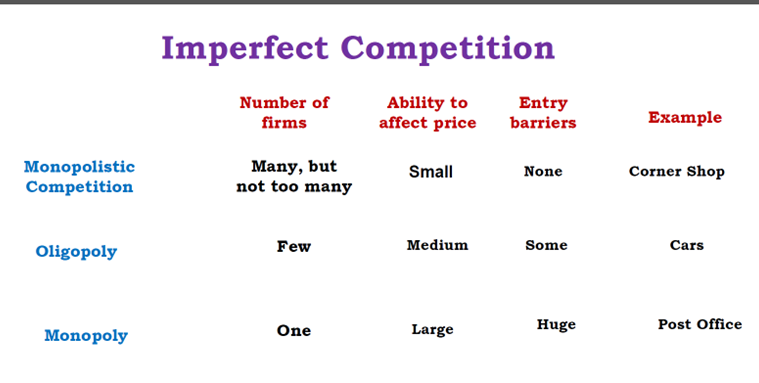

Under imperfect markets, there are many types, viz., oligopoly, Duopoly, Monopolistic competitions, etc.

We shall study about the types of competition in greater detail.

Competitions

Competition in business connotes the presence of more than one seller and one buyer in a particular market.

In competitive markets sellers act independently of other buyers. It is incompatible with those conditions of market where there is only one seller or one buyer.

So, the presence of more than one buyer and one seller is a necessary pre-condition for the existence of competitions.

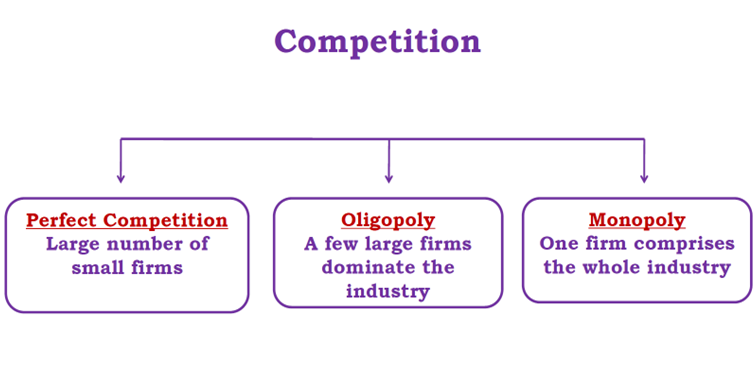

Types of Competition

1.Perfect Competition and Pure Competition

2.Imperfect Competition

a. Monopolistic Competition

b. Oligopoly Competition

3.Monopoly Competition

1.PerfectCompetition

A perfectly competitive market is one in which economic forces operate unimpeded Perfect competition is a firm behavior that occurs when many firms produce identical products and entry is easy.

Features of Perfect Competition

1. Large number of buyers and Sellers

2. Homogeneous Products

3. Free entry and exit conditions

4. Perfect knowledge on the part of buyers and sellers

5. Perfect mobility of factors of production

6. Absence of transport cost

7.Absence of Government or artificial restrictions

2. Imperfect Competition

Imperfectly Competitive Firms

Have some control over price

Price may be greater than the cost of production Long-run economic profits are possible

Price Policy

Formulating price policies and setting the price are the most important aspects of managerial decision-making.

Price, in fact, is the source of revenue which the firms seeks to maximize.

Again, it is the most important device a firm can use to expand its market.

If the price is set too high, a seller may price himself out of the market.

If it is too low, his income may not cover costs, or at best, fall short of what it could be.

Factors influence Price of a Commodity

1.The demand for a commodity

2.Cost of production

3.Objectives of the firm

4.Competition and

5.Government’s policy

Objectives of Price of a firm

1.Achieving a target rate of return on investment

2.Accomplishing the target rate of growth

3.Maintaining and improving the market share

4.Maintaining the prestige of the firm

5.Enhancing the goodwill of the company

6.Stabilizing the prices

Concept of Price Discrimination

A firm is in a position to fix the price of his product. He enjoys the control of supply of the product.

A firm is able to charge different price for his products to the different customers. This is known as price discrimination.

According to Mrs. John Robinson, the act of selling the same article, produced under single control at different prices to different buyers is known as price discrimination.

This is also known as differential pricing.

Market Structure and Pricing Decisions

Price Determination Under Perfect Competition

Price Determination Under Pure Monopoly

Monopoly Pricing and Output Decision in the Long-Run

1. Price Determination Under Perfect Competition

In a perfectly competitive market, commodity prices are determined by the market forces of demand and supply.

In other words, market prices are determined by the market demand and market supply, where the market demand refers to the industry demand as a whole:

The determination of commodity as well as services price under perfectly-competitive conditions are often analyzed under three different time periods:

The market period or very short-run; Short-run; and Long-run.

2. Price Determination Under Pure Monopoly

The term pure monopoly connotes absolute power to produce and sell a product with no close substitute.

A monopoly market is one in which there is only on seller of a product having no close substitute.

The cross-elasticity of demand for a monopolist’s product is either zero or negative. A monopolized industry refers to a single-firm industry.

3. Monopoly Pricing and Output Decision in the Long-Run

The decision rules guiding optimal output and pricing in the long-run is same as in the short-run.

In the long-run however, a monopolist gets an opportunity to expand the size of its firm with the aim of enhancing the long-run profits.

Expansion of the plant size may, however, be subject to such conditions as:

(a)the market size;

(b)expected economic profit; and, risk of inviting .